Overview

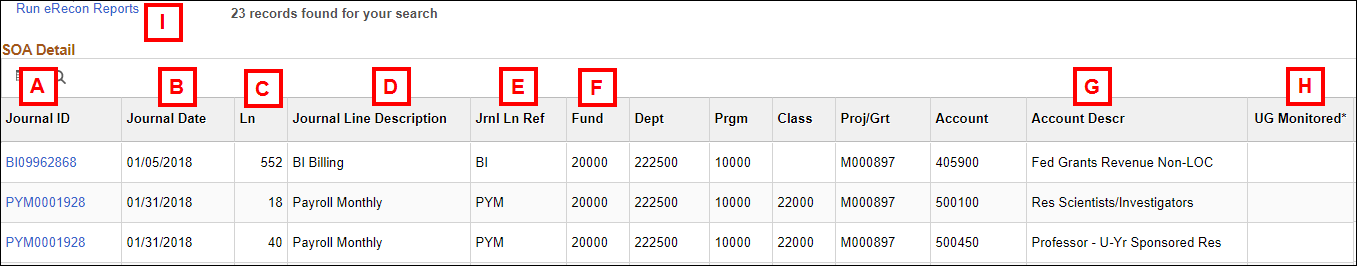

The eReconciliation SOA Detail grid displays the summarized journal entry transactions that match your Search Criteria parameters (e.g., Fund, Department, Program, and Journal Date range). This grid displays similar data to the Statement of Activity report or as part of the “CMB Reconciler” reports in BusinessObjects.

You can use the SOA Detail grid to reconcile all transaction types by using the various links to access transaction detail and then checking the REC box. Online and/or upload journal entries (i.e., those that begin with JU, BE, or 000) appear only on this page in eReconciliation. Therefore, you use this page to reconcile those transactions.

Note: In M-Pathways, the SOA Detail page scrolls across your computer screen. The following screenshots are split into sections for clarity. The eReconciliation by Fund/Department/Program report is used as an example.

Navigation

NavBar > Navigator > General Ledger > eReconciliation > eReconciliation

SOA Detail - left section of grid

| Letter | Field/Button |

Description |

|---|---|---|

A |

Journal ID |

An eight-digit, sequential, system-generated reference number for the journal transaction. Most Journal IDs have a two- or three-character prefix (called a Journal ID Mask) that identifies the source of the journal transaction. The Journal ID Mask specifies the central office you should contact if you have a question about the journal transaction. For example, you would contact Accounts Payable for questions about a Journal ID that starts with AP because that office is the source of the transaction and has the best information about the journal. Letter prefixes indicate that the system created the journal entry in a batch process. A Journal ID Mask of 000 signifies a journal entered online or uploaded directly into M-Pathways. See Related Resources for more information about Journal ID Masks. Clicking the Journal ID link opens the Journal Entry pages in M-Pathways. This is recommended only for non-system generated journals (e.g., those beginning with JU, BE or 000). System-generated journals (e.g., PCD, SUB, AP, or PYB) usually contain too many lines to efficiently use this look-up functionality. |

B |

Journal Date |

Shows the transaction date of the journal. The date is based upon the accounting date of the transactions that make up that journal. M-Pathways P-Card transactions are entered into the system on a daily basis, but are processed into vouchers once per month. The Voucher Build process assigns an accounting date equal to the first day of the designated month for these transactions. |

C |

Ln |

The Line Number (Ln) shows where within the summary journal your specific department or project/grant information is found. For example, if the Ln field has a number 22, then the transaction affecting your department or project/grant occurs on line 22 of the multi-line journal entry. Note: If you contact a central office with a question about a journal in the SOA Detail page, please include the Journal ID, Journal Date, and Line Number. |

D |

Journal Line Description |

Displays the 30-character text description of the journal line as entered in the online or upload journal entry transaction. The more descriptive and concise you are when completing a journal entry, the more transaction detail is available on the SOA Detail grid. Journals created by system batch processes, such as P-Card journals, do not utilize this field. Instead, the type of journal is listed (e.g., P-Card Transactions). |

E |

Jrnl Ln Ref |

Shows the value the department entered in the ten-character Journal Line Reference (Jrnl Ln Ref) field for the journal line. In the journal, this field provides a way for departments to further identify a particular journal transaction. For example, departments can enter a reference number, name, or the date of the original transaction that is to be corrected. ChartField values can be used to show transfers or corrections between Programs or Project/Grants. For system-generated journals, the Journal ID Mask is repeated in this field or it is left blank. |

F |

ChartFields |

ChartFields, such as Class, Proj/Grt, and Account shown in the picture above, are fields in the grid. The Account field always appears in the grid, but the other ChartFields displayed are dependent on which view you selected from the menu. By examining the transaction’s ChartField combination, you can determine whether or not the revenue or expense is correctly accounted for (e.g., belongs to that Department, Project/Grant, or Program). |

G |

Account Descr |

The Account Description comes from the general text description of the Account value in M-Pathways. If you are unfamiliar with a specific Account value and its description, you can verify it in two ways:

|

H |

UG Monitored |

UG Monitored* only applies to Sponsored Project/Grants. |

I |

Run eRecon Reports |

This link appears when the system returns the eReconciliation data from your search to populate the SOA Detail grid. It allows you to run and print the five eRecon reports as a group after you have completed your reconciliation. See eReconciliation Reports for further information and instructions. |

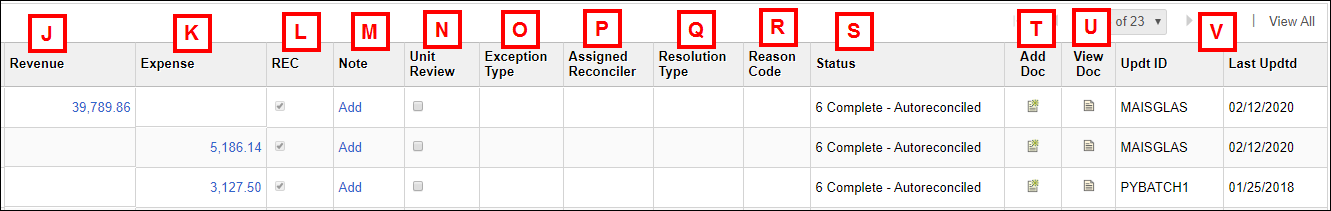

SOA Detail - right section of grid

| Letter | Field/Button |

Description |

|---|---|---|

J |

Revenue |

Positive amounts show money coming in (credited) to your department or project/grant at the ChartField combination used in the transaction. Negative amounts indicate that money is going out (debited) from your department or project/grant. If available, click the link to open the applicable Detail page to view voucher or invoice information. |

K |

Expense |

Positive values show the amount being charged (debited) to your department or project/grant. Negative values indicate money coming in (credited) to your department or project/grant. If available, click the link to open the applicable Detail page to view voucher, invoice, payroll, or student financial information. |

L |

REC |

The Reconciliation checkbox indicates whether a journal transaction has been reconciled (checked) or not (unchecked).

|

M |

Note |

An Add link in this field allows you to enter a note for that journal line. When the SOA Detail page is saved, the link changes to Update to show that a note has been entered. You can add, update, and remove notes as needed. |

N |

Unit Review |

Indicates that the journal transaction has been reviewed by the responsible campus unit. Note: Applies only to Sponsored Project activity; the checkbox is disabled for all other transaction lines. |

O |

Exception Type |

System assigned value based on auto-reconciliation rules. Used by the Shared Services Center to identify why a transaction could not be auto-reconciled. |

P |

Assigned Reconciler |

Person assigned in the Shared Services Center to reconcile transaction. |

Q |

Resolution Type |

Field used to identify how a transaction needing to be reconciled was resolved. |

R |

Reason Code |

Field used to determine why transaction was not “Confirmed as accurate” (not used for payroll transactions). Required when Resolution Types of “Other” or “JE” are selected. |

S |

Status |

Field used to identify the state of a transaction’s reconciliation. |

T |

Add Doc |

Click this icon to add documentation. |

U |

View Doc |

Click this icon to view previously added documentation. |

V |

Updtd ID Last Updtd |

These fields list the uniqname of the person who last updated reconciliation information (i.e., REC checkbox or Unit Review checkbox) for the journal line and when the update was done. These fields are populated when the SOA Detail or the applicable sub-page is saved. |

Related Resources

See the following documents to learn about the transaction detail available via links from the SOA Detail page or from a Detail view (e.g., Voucher Detail). To locate additional eReconciliation information, search using the keyword eReconciliation on the My LINC home page, or navigate using the following catalog path: ITS > Financials > General Ledger > Financial Reporting.

The following documents provide information on how to access and interpret eReconciliation data:

- eReconciliation: Journal Entry – identifies the journal entry fields useful for reconciling online or uploaded journals.

- eReconciliation: Voucher Detail – explains the procurement voucher detail useful for reconciling Purchase Order (PO), Payment Request, P-Card, and Service Unit Billing transactions.

- eReconciliation: Accounts Receivable/Billing Detail – defines the fields useful for reconciling BI journals.

- eReconciliation: Payroll Detail – defines the fields useful for reconciling PYB, PYM, and PYW journals.

- eReconciliation: Student Financial Detail – defines the fields useful for reconciling SFN journals.

- eReconciliation Reports explains the options for running the SOA Detail and using the eRecon Reports link.

- The Valid Account Listing is available in the Quick Links sidebar on the Financial Operations website.