Overview

There are two methods in M-Pathways eReconciliation for viewing detail for payroll journals (i.e., those beginning with PYB, PYM, and PYW) for your department or project/grant:

- Click Payroll Detail to view the summary journal data with its transaction detail on one page for all of the payroll transactions for the selected parameters.

- From the SOA Detail page, click the link in the Expense column for a specific payroll journal to display the detail for only that Journal ID/Line.

Both methods provide similar detailed information as the Gross Pay Register report available through BuinessObjects or HEPROD. Review this document in its entirety to learn about both methods or click a link below to focus on a particular one.

Payroll Detail – All transactions

Payroll Detail – Individual transaction

Important Information

The weekly, bi-weekly, and monthly Gross Pay Register report is reviewed by departments prior to the payroll journals being generated in order to verify and/or correct payroll data, as necessary, before the transaction is recorded in the General Ledger. The eReconciliation Payroll Detail page is used to reconcile the payroll and benefit transactions after they are recorded in the General Ledger. This business process acts as a “check and balance” to ensure that payroll data is accurately reported.

Note: In M-Pathways, the Payroll Detail page scrolls across your computer screen. The following screenshots are split into sections for clarity. Unless otherwise indicated, the fields described apply to all salary and benefit transactions.

Navigation

NavBar > Navigator > General Ledger > eReconciliation > eReconciliation

Payroll Detail Page – All transactions

Use this method if you like to reconcile all payroll transactions from one eReconciliation page. This method combines the summary data (e.g., Journal ID/Line) with the transaction detail to provide an “all-in-one” view.

Note: The sort order in the grid is: EmplID, Journal ID, Journal Date, and Account. This allows you to see the payroll data for each employee at a glance. Click a column heading to change the sort order while viewing the data, if appropriate.

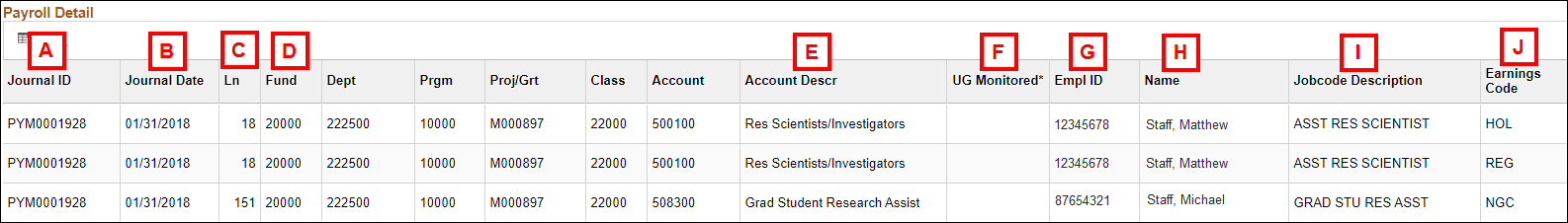

Payroll Detail - left section of grid

| Letter | Field/Button |

Description |

|---|---|---|

A |

Journal ID |

An eight-digit, sequential, system-generated reference number for the journal transaction. A journal is a balancing set of accounting entries for a type of transaction that is posted to the General Ledger.

|

B |

Journal Date |

Shows the transaction date of the journal. The date is based upon the accounting date of the payroll cycle that make up that journal. |

C |

Ln |

The Line Number (Ln) shows where within the summary journal your specific department or project/grant information is found. Note: If you contact the Payroll department with a question about a journal in the Payroll Detail page, please include the Journal ID, Journal Date, and Line Number. |

D |

ChartFields |

ChartFields, such as Proj/Grt, Class, and Account shown in the picture above, are fields in the grid. The ChartField values for a Journal ID/Line correspond to the ShortCode used for the payroll/benefit transaction. In the Human Resources system, payroll and benefits are processed with a ShortCode. In the General Ledger system, the ChartField combination is used. By examining the transaction’s ChartField combination, you can determine whether or not the payroll/benefit expense is correctly accounted for (i.e., belongs to that Department, Project/Grant, or Program) To validate the ShortCode translation for these transactions, use the M-Pathways ChartField Converter. See Related Resources for more information. |

E |

Account Descr |

The Account Description comes from the general text description of the Account value in M-Pathways. If you are unfamiliar with a specific Account value and its description, you can verify it by using the Valid Account Listing on the Financial Operations website. See Related Resources for more information. |

F |

UG Monitored |

UG Monitored* only applies to Sponsored Project/Grants |

G |

Empl ID |

Displays the employee identification number for the individual associated with the payroll or benefit transaction. This is a system assigned number that uniquely identifies a person at U-M. Commonly referred to as the UMID. |

H |

Name |

Shows the individual associated with the payroll or benefit transaction. |

I |

Jobcode Description |

Provides a short description of the individual’s job classification title. Titles are established by the Office of Human Resources and Affirmative Action and maintained in the M-Pathways Human Resources system. Jobcode Descriptions are not provided as detail information for benefit transactions. |

J |

Earnings Code |

Lists the code that describes the type of earnings associated with the transaction (e.g., REG indicates Regular Pay). It sometimes, but not always, matches the Time Reporting Codes (TRCs) used to report earnings on timesheets. |

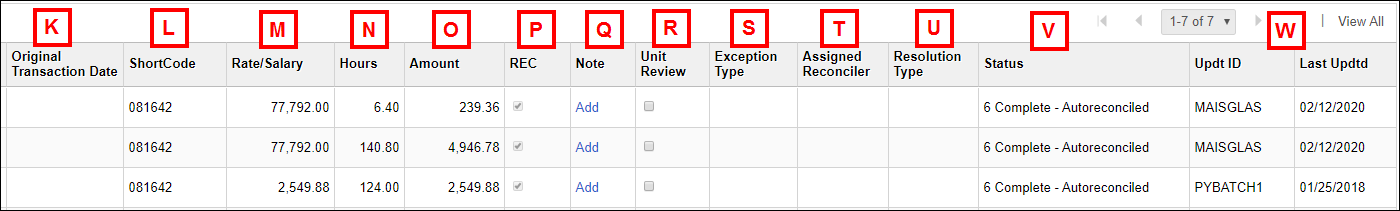

Payroll Detail - right section of grid

| Letter | Field/Button |

Description |

|---|---|---|

K |

Original Transaction Date |

For earnings resulting from the salary transfer process (i.e., retroactive changes in pay), displays the check date on which the earning were originally paid. |

L |

ShortCode |

Identifies the code that represents the ChartField combination used to process the payroll/benefit transaction. At a minimum, the ShortCode represents a unique Fund/Department/Class combination. It may also include a specific Program or Project/Grant value. ShortCodes do not include an Account value. |

M |

Rate/Salary |

Shows the base compensation received by an employee for a job. |

N |

Hours |

For each row of hourly earnings, indicates the hours that are paid. Hours do not display for benefit transactions. |

O |

Amount |

Lists the dollar amount distributed to an individual by the University for the applicable pay period. Negative dollar amounts (i.e., credits) may be the result of payroll/benefit corrections or retroactive pay changes processed on off-cycle, or weekly, payroll runs. |

P |

REC |

The Reconciliation checkbox indicates whether the Payroll line has been reconciled (checked) or not (unchecked). Checking the REC box for the Journal ID/Line on the SOA Detail grid automatically checks the REC box(es) for the associated detail. If you check or uncheck a REC box on the Payroll Detail page, the system automatically checks or unchecks the corresponding REC box for the Journal ID/Line on the SOA Detail page. If the Payroll Detail page displays multiple rows of data with the same Journal ID/Line values, the REC boxes for each of those rows must be checked in order for the Journal ID/Line to be considered reconciled (i.e., REC checkbox marked) on the SOA Detail page. If one row of data is not marked as reconciled, the Journal ID/Line isn’t marked as reconciled. |

Q |

Note |

An Add link in this field allows you to enter a note for the detail line. When the Payroll Detail page is saved, the link changes to Update to show that a note has been entered. You can add, update, and remove notes as needed. |

R |

Unit Review |

Indicates that the Payroll line has been reviewed by the responsible campus unit. Checking the Unit Review box for the Journal ID/Line on the SOA Detail grid automatically checks the Unit Review box(es) for the associated detail. If you check or uncheck a Unit Review box on the Payroll Detail page, the system automatically checks or unchecks the corresponding Unit Review box for the Journal ID/Line on the SOA Detail page. Note: Applies only to Sponsored Project activity; the checkbox is disabled for all other transaction lines. If the Payroll Detail page displays multiple rows of data with the same Journal ID/Line values, the Unit Review boxes for each of those rows must be checked in order for the Journal ID/Line to be considered reviewed (i.e., Unit Review box checked) on the SOA Detail page. If one row of data is not marked as reviewed, the Journal ID/Line isn’t marked as reviewed. |

S |

Exception Type |

System assigned value based on auto-reconciliation rules. Used by the Shared Services Center to identify why a transaction could not be auto-reconciled. |

T |

Assigned Reconciler |

Person assigned in the Shared Services Center to reconcile transaction. |

U |

Resolution Type |

Field used to identify how a transaction needing to be reconciled was resolved. |

V |

Status |

Field used to identify the state of a transaction’s reconciliation. |

W |

Updt ID Last Updtd |

The Update ID and Last Updated fields list the uniqname of the person who last updated reconciliation information (i.e., REC checkbox or Unit Review checkbox) for the Payroll line and when the update was done. These fields are populated when the Payroll Detail or SOA Detail page is saved. |

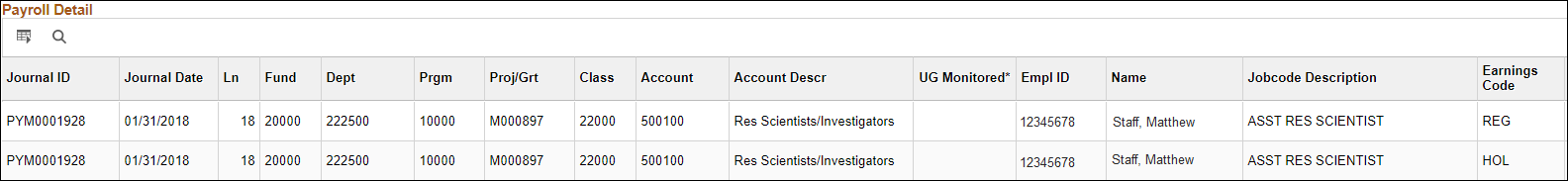

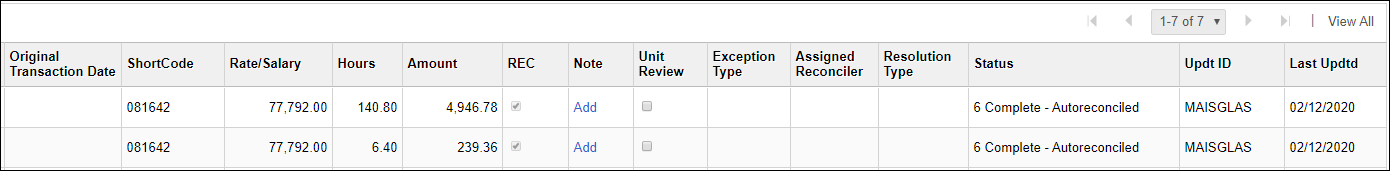

Payroll Detail Page – Individual transaction

Clicking the Expense link for a specific PYB, PYM, or PYW Journal ID/Line from the SOA Detail page displays the transaction detail for only that Journal ID/Line. Because the information is limited to a particular journal line, the fields appear in a different order to put the focus on the detail up-front.

Note: All fields in a "specific" detail view are the same as the Payroll Detail view. See the field descriptions above for information.

Payroll Detail – left-side view

Payroll Detail – right-side view

Related Resources

See the following documents in the ITS catalog in My LINC for additional information about eReconciliation. Locate the documents by searching from the My LINC home page using the keyword eReconciliation or navigate using the following catalog path: ITS > Financials > General Ledger > Financial Reporting.

- eReconciliation provides step-by-step instructions for using eReconciliation to reconcile your department’s or project/grant’s financial activity.

- eReconciliation Reports provides step-by-step instructions for running and printing the SOA and transaction detail reports after completing your reconciliation effort.