Overview

There are 2 parts to creating a PAR (Personnel Action Request):

Part 1: Create a PAR: The first steps that all PAR transactions begin with.

Part 2: Individual PAR Transaction Type: Steps vary by the type of PAR transaction being created.

This procedure is Part 2. It outlines the steps for completing a PAR: Termination or Retirement.

If you are making changes to multiple employee records or PAR transactions, see the Navigate Between Multiple Employee Records/PAR (Personnel Action Request) Transactions step-by-step procedure for more information.

Important Information

- When processing temporary terminations through a Personnel Action Request, best practice is to use today’s date (the date it is processed) as the Effective Date of the termination.

- The Termination or Retirement Transaction can be used to initiate a corrected last day employed date. This is routed to the Central Office for further processing.

- A termination transaction cannot be used to cancel a termination or to terminate a Regular employee who has not yet begun work. The Correction or Deletion of Data Transaction Type must be used.

- A termination transaction cannot be used to cancel a termination or to terminate a Temporary employee who has not yet begun work. A Temporary Change Form must be used.

- If the employee is leaving the department but continuing to work in another area of the university without a break in service, this would be a Reclassification, Transfer, or Promotion transaction type, not a Termination.

- Summer Salary Appointments are not eligible for termination through PAR. Graduate Students can be terminated in the mass purge that runs three times a year.

- Refer to the Termination SPG for specific procedures.

- Employees with current Additional Pay are processed with the following parameters:

- Processed timely (today’s date < payroll confirm date in which the termination date falls in):

- If the End Date is open ended or has an End Date greater than today’s date, and the Additional Pay Effective Date is before today’s date, then the Earnings End Date is updated to the last day of the pay period prior to the termination date.

- If the Effective Date of the Additional Pay is after the month the employee is terminated, the Additional Pay row is deleted.

- If the Effective Date of the Additional Pay is after today’s date, then the Earnings End Date is updated to the end of the pay period for which the termination date falls.

- NOT processed timely (today’s date >= payroll confirm date in which the termination date falls in)

- If the End Date is open ended or has an End Date greater than today’s date, no additional pays are updated.

- If the Rehire status is Restricted or No Rehire, a letter must be added using the supporting documentation link in the transaction.

- If the Rehire status is Restricted Rehire or No Rehire, comments are required. “See termination letter” or “See personnel file” are not acceptable. Use these guidelines for comments:

- For Restricted Rehire: Comments must explain what issues the employee had in the position and what type of position the employee may be able to perform successfully.

- For No Rehire: Comments must explain the specific reason(s) the employee was not successful in the position and is being terminated or discharged.

Navigation

This step-by-step procedure begins on the PAR Details Page within an existing PAR transaction.

Step-by-Step Process

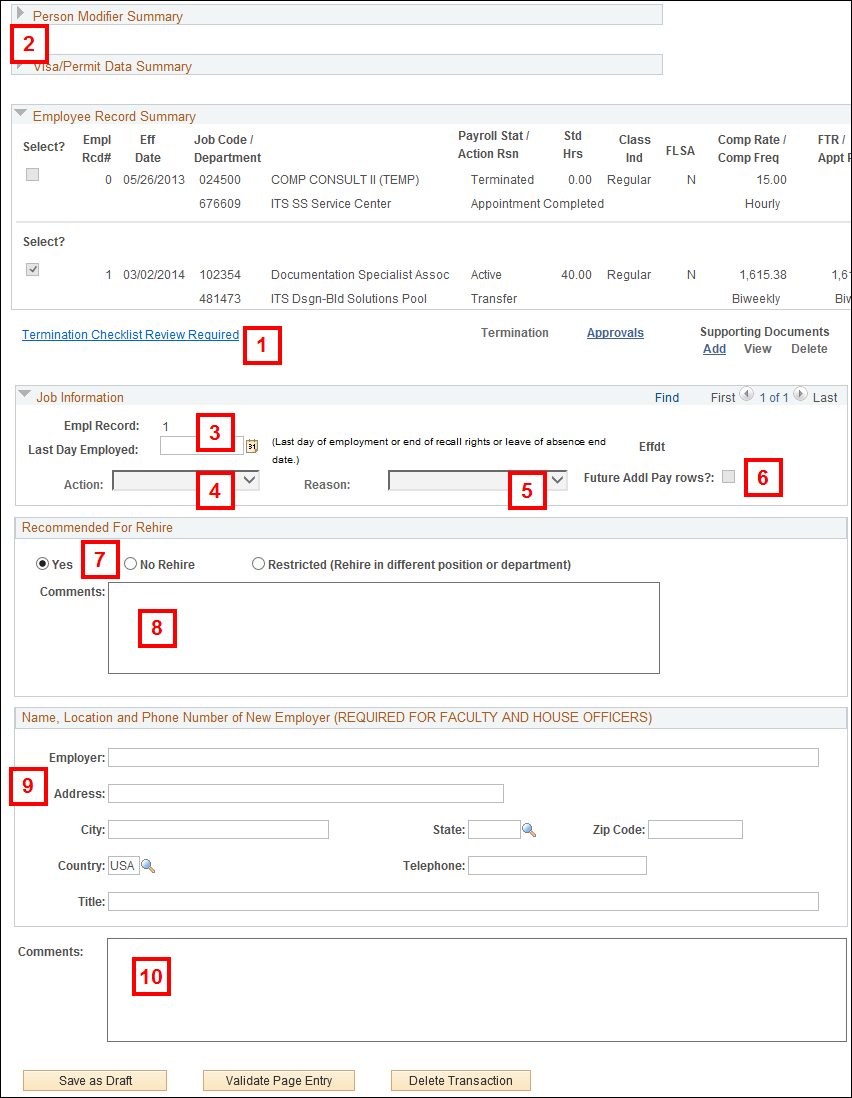

- Click Termination Checklist Review Required to ensure that you have completed all the termination steps for the employee.

- Click the arrow to view the Person Modifier Summary group box.

- Enter or select the Last Day Employed.

- Select the applicable value from the Action drop-down list.

- Select the applicable value from the Reason drop-down list.

- Review the Future Addl Pay rows? checkbox. If checked, it indicates future dated Additional Pay Earnings Codes may be ended by this process.

- Turn on the applicable radio button in the Recommended for Rehire group box.

- Enter applicable Comments.

- If applicable, complete the Employer, Address, City, State, Zip Code, Country, Telephone, and Title fields.

- Enter Comments.

- Appropriate comments are required for transactions. All comments are retained for reference.

- If terminating a UYR employee during an off period, comments are required.

- Complete the PAR:

PAR Details Page - Comp Rate Change Screenshot

Notes: Last Day Employed is the last day of employment and/or Leave of Absence. The effective date automatically populates as one day after the Last Day Employed.

Note: The Action for a regular retirement is Retirement with Pay and the Reason is Retired. Retired with Pay does not mean the retiree is going to receive compensation after the retirement date, it means they receive benefits.

Note: Termination Reason definitions can be found in the Managers’ Toolkit.

Note: If proration of the Additional Pay is needed, this can be done before the termination transaction is started or after the termination transaction is complete (recommended).

Note: Comments need to contain the current date, the name of the person who made the rehire decision, and your name. For further information, see the Important Information section of this document.

Notes:

Conclusion

This concludes the steps for completing a PAR: Termination or Retirement. If you would like to begin a new transaction, see the Create a PAR step-by-step procedure.