Overview

The pictures and field descriptions below explain how to read a Statement of Activity (SOA) report. There are four versions of this report: SOA by Fund/Department, SOA by Fund/Department/Program, SOA by Project/Grant, and SOA – Hospital. Each of the reports displays the posted revenue and expense transactions for an Accounting Period (i.e., one month period) for the specified parameters (e.g. Project/Grant). This document uses a SOA by Fund/Department/Program as an example to describe the report header, report fields, and amount rows.

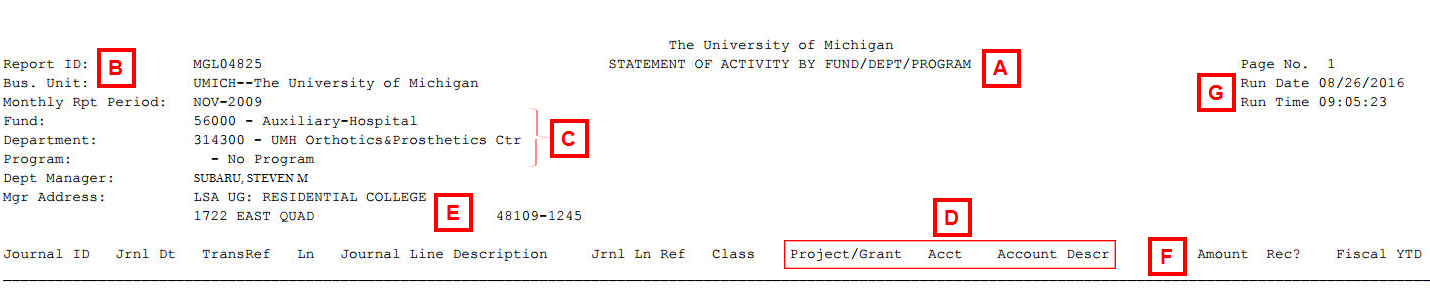

Report Header

| Letter | Field |

Description |

|---|---|---|

| A | Report Title |

Displays the name of the report, and appears as a header at the top, center of the report. |

| B | Report ID |

This value identifies the report from the system standpoint. Each unique version of a report has its own Report ID. |

| C | Report Parameters |

The fields from the report’s Parameters page display on the left side of the header. The parameters include the ChartFields named in the Report Title, but also include the Monthly Rpt. Period. The Monthly Report Period is a combination of the Fiscal Year and Period fields from the Parameters page. |

| D | ChartFields |

The ChartFields that are not report parameters are included as report fields. |

| E | Contact Information |

Provides the name and address of the Department Manager for the department reports. The SOA by Project/Grant lists the Project/Grant Administrator and other information related to that project/grant. |

| F | Report Fields |

Display across the bottom of the report header. These fields vary depending on the report parameters and the purpose of the report. |

| G | Report Processing Information |

The Run Date and Run Time appear in the right corner of the report header. |

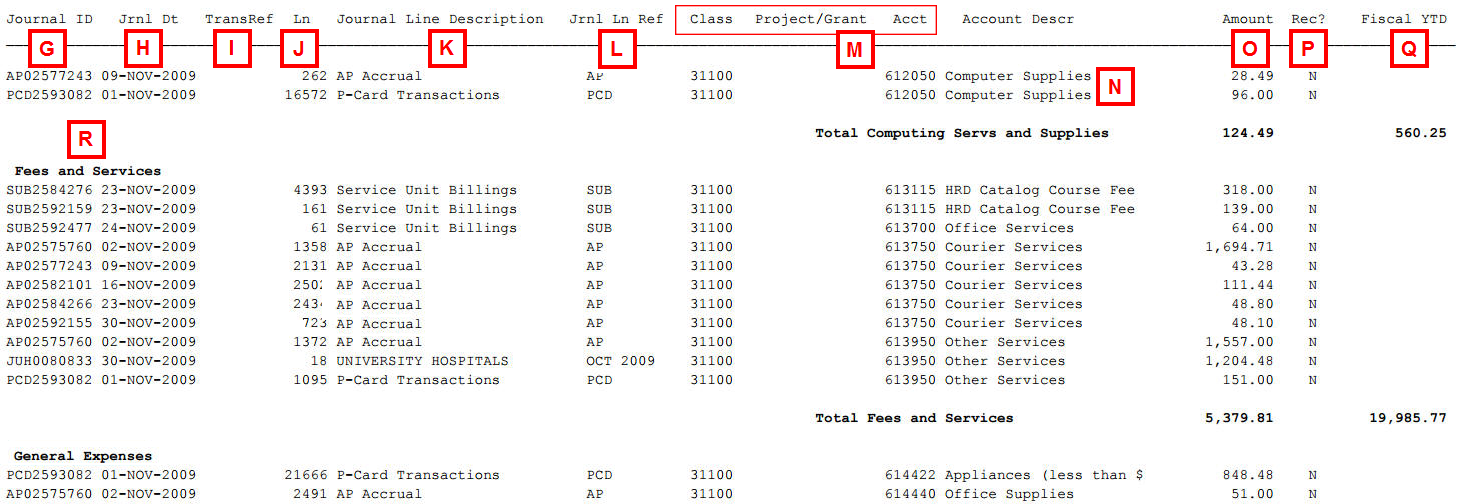

Report Fields

The posted revenue and expense transactions are processed as journals. Journals are the balancing accounting entries for two or more ChartField combinations that are posted to the General Ledger. The SOA displays the summarized journal information related to your ChartFields for the transaction. The picture below shows the report fields and an example of the data that appears in each field.

| Letter | Field |

Description |

|---|---|---|

| G | Journal ID |

An eight-digit, sequential, system-generated reference number for the journal transaction. Most Journal IDs have a two- or three-character prefix, called a Journal ID Mask that identifies the source of the journal transaction. The Journal ID Mask specifies which Central Office you should contact if you have a question about the journal transaction. For example, you contact Accounts Payable for questions about a Journal ID that starts with AP because that office is the source of the transaction and has the best information about the transaction. Letter prefixes indicate that the system created the journal entry in a batch process. A Journal ID Mask of 000 signifies an online journal created in M-Pathways by a department or Central Office. See the Related Links section of this document for more information about Journal ID Masks. |

| H | Jrnl Dt |

Shows the transaction date of the journal entry based upon the accounting date of the transactions that make up that journal. PCard transactions are entered into the system on a daily basis, but are batched once per month. For these transactions, the journal generation process assigns an accounting date equal to the first day of the designated month. |

| I | TransRef |

The Transaction Reference (TransRef) field comes from the department Header section of the journal entry form (either paper or online). This eight-character field is available for departmental tracking purposes. Examples of values include the journal entry preparer’s initials, ChartField values, or departmental filing codes. This field is not used for journals created by system batch processes, such as Payroll journals. |

| J | Ln |

The Line Number (Ln) indicates where within the journal entry your specific transaction information can be found. For example, if the Ln field has a number 11, then the transaction affecting your department or project/grant occurs on line 11 of the multi-line journal entry. Batched journal entries may have thousands of lines. Online journal entries usually have fewer. If you contact a Central Office with a question about a journal on your SOA, please include the Journal ID, Journal Date, and Line Number so that they can easily find your portion of the multi-line journals. |

| K | Journal Line Description |

Provides a 30-character text description of the journal transaction. The information comes from the journal entry form. The more descriptive and concise you are when completing a paper or online journal entry, the more transaction detail is available on the SOA. Journals created by system batch processes, such as PCard journals, do not utilize this field. Instead, the type of journal is listed (e.g., PCard Transactions). |

| L | Jrnl Line Ref |

The ten-character Journal Line Reference (Jrnl Ln Ref) field provides another way for departments to further identify the journal transaction. For example, departments can enter a reference number, name, or an original date of a transaction. ChartField values can be used to show transfers or corrections between programs or project/grants. This information also comes from the journal entry form. For system generated journals, the Journal ID Mask is repeated in this field or it is left blank. |

| M | ChartFields |

ChartFields, such as Class, Project/Grant, and Account shown in the picture above, are report fields. The Account field always appears on the report, but the other ChartFields displayed are dependent on which Statement of Activity report you run. By examining the transaction’s ChartField combination, you can determine whether or not the revenue or expense belongs to that department, project/grant, or program. You can also determine if the transaction is correctly categorized as to its type of revenue or expense by looking at the Account value and its Account Group. |

| N | Acct Descr |

The Account Description (Account Descr) comes from the general text description of the Account value. If you are unfamiliar with a specific Account value and its description, verify it by using the Valid Account Listing on the Financial Operations Web site. See the Related Links section of this document for more information about these resources. |

| O | Amount |

Shows the total dollar amount of the journal line or the monthly subtotal for an Account Group. The interpretation of positive and negative amounts is different for revenue and expenses.

|

| P | Rec? |

The Reconciliation field indicates whether a journal transaction has been reconciled (Y) or not (N) using M-Pathways eReconciliation. If your department or project/grant does not use eReconciliation, this field always displays a value of N. This information is also available on the eReconciliation reports. |

| Q | Fiscal YTD |

The Fiscal Year-To-Date (Fiscal YTD) field provides a “running total” of the amount of money earned or expended by your department or project/grant during the Fiscal Year for a particular group of revenue or expense Accounts (i.e., Account Groups). This field allows you to get a snapshot of your financial standing according to the report parameters (e.g., Fund/Department/Program). |

| R | Account Group |

The revenue and expense Account values used in transactions relate to broader groups of similar revenues or similar expenses. These are called Account Groups. The Account Group title (e.g., General Income) appears as the heading for each group of similar journal transactions on the SOA. |

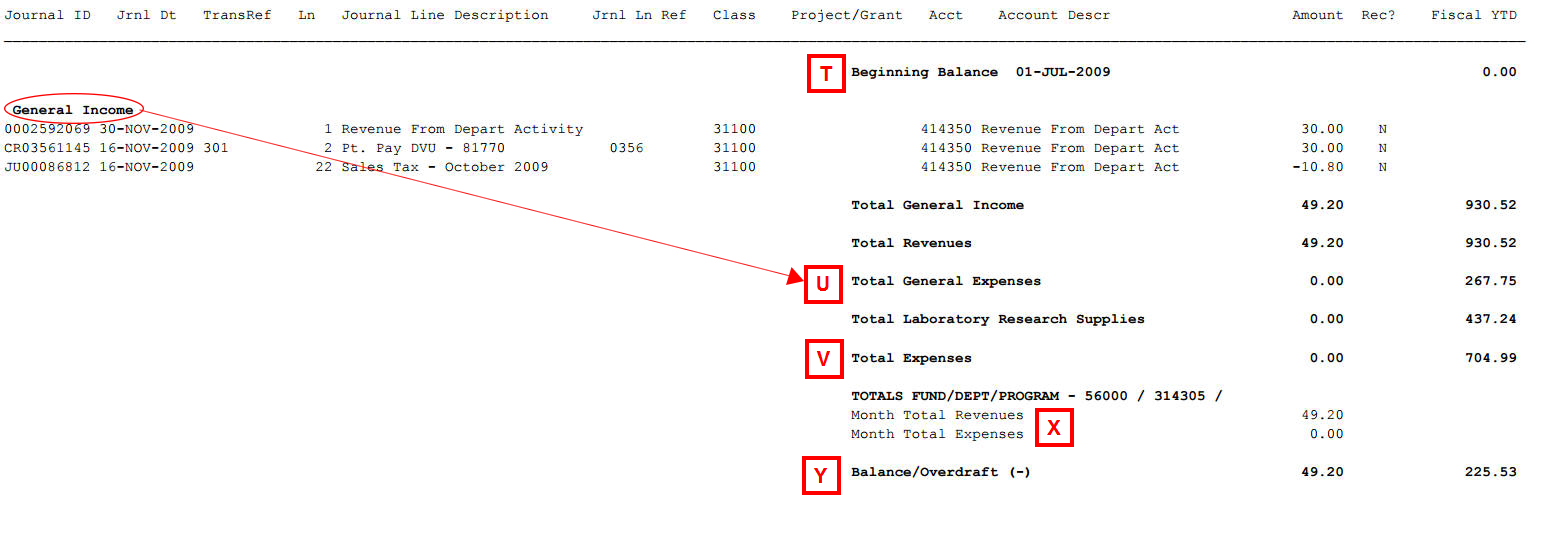

Amount Rows

The SOA has multiple dollar amount rows. Some display subtotals and others overall dollar totals for the month or Fiscal Year. The picture below shows the revenue totals.

| Letter | Field |

Description |

|---|---|---|

| T | Beginning Balance |

The Beginning Balance amount is always the first row in the report body. It appears in the Fiscal YTD column, because it represents your financial starting point for the Fiscal Year (e.g., 01-JUL-2002). This amount does not change from one Accounting Period to the next during the Fiscal Year. For the General, Expendable Restricted, and Designated Funds (10000- 40000), this is a calculated amount that shows the net sum of the revenue and expense transactions from the previous fiscal years. This is often referred to as the “carry-forward” amount. Other Funds, such as some of the Auxiliary Funds (5xxxx), always show a Beginning Balance of $0.00 because revenues and expenses are not carried forward. |

| U | Account Group subtotals |

These subtotal figures display for the month and the Fiscal YTD. The Amount subtotals show you how much you have received or spent for the Accounting Period. The Fiscal YTD subtotals allow you to see if your actual revenues or expenditures to date are acceptable in relation to your budget. After a transaction has occurred for an Account Group, that subtotal row remains on the SOA for subsequent Accounting Periods (e.g., Total Appropriation subtotal with a 0.00 Amount value and a 42, 206.00 Fiscal YTD value). |

| V | High-level subtotals |

The Total Revenues and Total Expenses subtotals give you the big picture for your department’s or project/grant’s financial position. For each row you can see the monthly and Fiscal YTD amounts. You can use this information to determine whether your revenues and expenditures are within acceptable parameters for your business. |

| X | Monthly totals |

The monthly revenue and expense totals are repeated at the end of the SOA with the report parameters as a quick summary. In the example, the report parameters are FUND/DEPT/PROGRAM – 10000 / 123456 / DISCR. These monthly totals appear above the Balance/Overdraft (-) field to ensure that you can see the amounts that were used to calculate the remaining balance or overdraft. The totals appear in the Amount column because they are only applicable to the Accounting Period. |

| Y | Balance/Overdraft (-) totals |

The Balance/Overdraft (-) amount is listed in two different fields. The Amount column displays the net difference between the Revenues and Expenses for the month, while the Fiscal YTD column shows the Beginning Balance plus the net of the monthly Balance/Overdraft (-) since the beginning of the Fiscal Year in July. In other words, Beginning Balance – (Total Revenues Fiscal YTD + Total Expenses Fiscal YTD) = Balance/Overdraft (-) Fiscal YTD. At the end of a Fiscal Year, the dollar amount, whether positive or negative, in the Fiscal YTD column becomes the amount “carried forward” to the next Fiscal Year, if appropriate for the Fund. It becomes the Beginning Balance as of July 1 for the subsequent Fiscal Year. By looking at the Balance/Overdraft amounts you can see your department’s or project/grant’s relative financial position for a specific period in time. |

Related Links

The following My LINC documents and websites provide additional information and resources you may use when interpreting and reconciling a Statement of Activity (SAO) report:

- eReconciliation explains how to use the online option to reconcile your department or project/grant’s finances, including the Notes and Rec? fields, which may appear on the SOA report.

- The Valid Account List on the Financial Operations website (Quick Links section on the right) shows revenue and expense Account values (i.e., those beginning with 4, 5, and 6) and their definitions. The spreadsheet indicates allowable and unallowable Fund/Account combinations with the following letter codes:

- U = Unallowable for use in that Fund

- FO = Financial Operations may move the revenue/expense to the correct ChartField combination

- E = Contact a Fund Accountant to verify use based on the transaction situation

- Blank (i.e., no letter code) = Acceptable for use in that Fund.