Overview

Most General Ledger reports from M-Pathways Financials (e.g., Statements of Activity, Project/Grant Budget Status) share the same high-level structure. Understanding this structure helps you interpret the reports.

Navigation

Wolverine Access > Faculty & Staff > University Business > M-Pathways Financials & Physical Resources System

General Ledger Structure

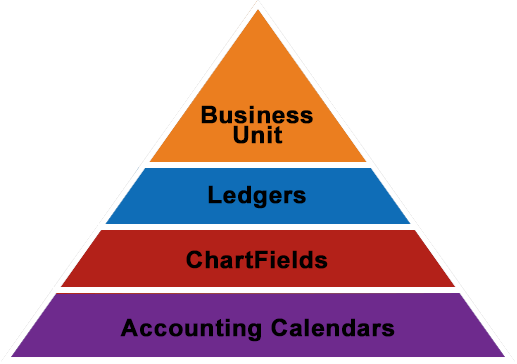

The picture below shows the University’s General Ledger Structure as a pyramid, with each level providing additional detail for reporting purposes. Every General Ledger report contains these four elements, even though they may be displayed differently in each report.

Business Unit

The Business Unit value determines which major area of business applies to the report data. All General Ledger reports use one Business Unit, UMICH. Other business areas, such as Accounts Receivable & Billing and Asset Management have additional Business Units that define their activity.

The Business Unit is the highest level at which the University prepares reports. For example, year-end reports required by the Federal Government show financial information for the entire University, using the Business Unit, UMICH.

Ledgers

The Ledgers provide a different view of the financial information. There are many types of ledgers used for recording and reporting transactions. The two examples below represent the major ledgers from which the predefined reports from the various reporting environments (e.g., Statements of Activity, Project/Grant Budget Status) pull information.

- The Actuals Ledger contains all the transactions including: procurement, financial aid, journal entries, and your department’s spending authority.

- The Budget Ledgers contain your department’s high-level budget information, which may include Appropriation, Organization, Revenue Estimate, and Project/Grant budgets.

ChartFields

ChartFields have the following roles in the General Ledger:

- ChartFields capture financial information from transactions. All M-Pathways applications use ChartFields to process the financial transactions that are recorded in the General Ledger.

Financials/Physical Resources uses ChartFields to: - Process procurement transactions, such as Purchase Orders, ePro Requisitions, Vouchers, for payments made to internal and external vendors.

- Process budget transactions, such as establishing budget lines, completing budget transfers, and allocating state appropriations.

- Identify assets and inventory items.

- Identify and track Indirect Cost Recovery.

- ChartFields are used as report parameters. To run a report from M-Pathways or the U-M Data Warehouse you need to identify the limits, or the parameters, of your report. For example, a Statement of Activity (SOA) by Fund/Department/Program limits the report data returned from the General Ledger to the specified Fund, Department, and Program values you enter in the Parameters page. Because ChartFields capture financial information, they are also used to retrieve information.

- ChartFields display the financial information on the report. In addition to dollar amounts and other transaction details, the ChartFields provide information about the transactions that you, Central Offices, and other departments entered into the system in the body of the report. For example, the SOA by Fund/Department uses the remaining ChartFields (Class, Program, Project/Grant, and Account) to show the financial data for each transaction on the report.

Student Administration uses ChartFields to process and record Financial Aid/Student Financials transactions.

Human Resources Management uses ChartFields to process and record salary and benefit transactions.

Business Process Information

For the best reporting results, use ChartFields consistently and accurately in your transactions. Your financial reports are more detailed and meaningful if your transactions utilize the ChartFields that best describe the transaction situation.

Account Values

The Account value plays a primary role in financial reporting because it identifies the type of financial activity. The value’s prefix (i.e., initial digit) indicates its use or its type. The type of Account values you see on the financial reports depends on the purpose of the report.

- Statements of Activity (SOAs) and detail reports use Account values beginning with four, five, and six to report revenues and expenses.

- Budget reports use Account values beginning with eight and nine to report budgeting activity.

Being familiar with the Account values commonly used by your department or project/grant helps you identify transactions on the SOA that are outside the ordinary scope for your business. See the Valid Account List on the Financial Operations website for a list of values beginning with four, five and six and information about appropriate use in transactions by Fund.

| Account Value Prefixes | The Account value prefix indicates the type of Account | Account Values Beginning with: |

|---|---|

1 = Asset 2 = Liability 3 = Equity 4 = Revenue 5 = Salary/Benefits Expense |

6 = Other Expenses 7 = No Activity 8 = Budget Revenue 9 = Budget Expense |

Do ShortCodes have a role in General Ledger Reporting?

A ShortCode is a six-digit number that represents a ChartField combination. ShortCodes may be used in procurement transactions as a data entry shortcut to populate the corresponding ChartFields. They are also used for payroll transactions from the Human Resources Management module.

ShortCodes are not a part of the M-Pathways General Ledger structure and do not appear as individual values on financial reports (e.g., SOA). Instead, ShortCode transactions are translated into their corresponding ChartField combination by the source (e.g., M-Pathways system, Service Units, HR Central Offices, and Student Central Offices) and sent to the General Ledger. It is the ChartField information for these transactions that appears on the financial reports.

Accounting Calendars

An Accounting Calendar provides the time frame for a report. For reports generated from the Actuals Ledger (e.g., SOAs from M-Pathways Financials or BusinessObjects), there are two parts to the Accounting Calendars:

- Fiscal Year

- Accounting Period

The University defines their Fiscal Year as beginning July 1 and ending June 30. An Accounting Period represents a particular month within the Fiscal Year. When you run a report from the Actuals Ledger, such as a Statement of Activity, you enter both the Fiscal Year and a Period (Accounting Period) to identify the month within the selected Fiscal Year for which you want transaction data. The following table shows the month and its corresponding Accounting Period.

| Current Activity | Accounting Period |

|---|---|

| Carry Forward | 0 |

| July | 1 |

| August | 2 |

| September | 3 |

| October | 4 |

| November | 5 |

| December | 6 |

| January | 7 |

| February | 8 |

| March | 9 |

| April | 10 |

| May | 11 |

| June | 12 |

| Adjustments | 998 |

| Closing | 999 |

Accounting Periods 1 – 12 represent current financial activity. Transactions that occur in these Accounting Periods appear on the financial reports. Period 0 is the Accounting Period in which your Fiscal Year ending balance is “carried forward” to the next Fiscal Year by accounting entries completed by Financial Operations. Reports that include Beginning Balance fields display Period 0 amounts. These dollar amounts are calculated and static, which means they aren’t adjusted from one current Accounting Period to the next.

Periods 998 and 999 record Financial Operations activity for the year-end closing processes. Transactions posted to these periods do not appear on financial reports showing current activity. Financial Operations uses Period 998 to adjust the Fiscal Year ending balance per the Fund’s audit requirements.

Your organization (e.g., LS&A) may request to adjust ending balances using the June Accounting Period (12) so that these transactions appear on the monthly departmental financial reports. However, this skews the actual financial activity for the month because accounting entries are included as current transactions. Check with your Financial Operations Coordinator to verify if your department uses Period 12 or Period 998 for adjustments in those Funds in which you operate.

Period 999 is an Accounting Period used by a system batch process to close the Fiscal Year. Activity in this period does not appear on financial reports.

Journal Date Range

A range of Journal Dates (e.g., 05/01/2010 – 05/15/2010) provides the Accounting Calendar used in M-Pathways eReconciliation. The date range provides more flexibility for the online Statement of Activity reconciliation process, allowing you to view the data for a greater or lesser time frame than the one month Accounting Period.

Budget Period

A Budget Period value identifies the Accounting Calendar used for reports generated from the Budget Ledger (e.g., Project/Grant Budget Status – Legacy P/G report). Some budgets are based on the Fiscal Year, while others are tracked over a lifetime period outside of a fiscal year (i.e., multiple fiscal years). If a report has a Budget Period parameter, you need to enter a value in the field so that the system retrieves the relevant information. There are three Budget Period values:

- For Organization, Revenue Estimate, Appropriation Budget reports, and some Project/Grant Budget reports, the Budget Period value is the Fiscal Year (e.g., 2010).

- For Legacy Project/Grants that have activity in multiple fiscal years, the Budget Period value is 0001.

- For Appropriation and Project/Grant Budget reports relating to Construction, the Budget Period value is 0000.